On March 16, 1990, just a day after his inauguration, then-president of Brazil Fernando Collor de Mello put an 18-month freeze on every Brazilian savings account with a balance larger than $1200, telling account holders the government had effectively “borrowed” their money.

The measure affected 80% of all bank deposits, freezing about $115 billion worth of consumer funds with the stroke of a pen.[1]

“Everyone that had money in their savings accounts, it went straight to the government and you couldn't do anything about it,” says bitcoiner Ivy Galindo, whose parents were in their 30s at the time. “This was their way to ‘beat inflation.’”

The program ultimately failed, causing Brazil’s economy to shrink, consumer prices to skyrocket, and a spike in suicides and heart attacks.[2] It’s an event that would come to color Ivy’s view of government and money–and the far-more-than-hypothetical value of self custody.

“I always grew up with that moment in my mind and thought, ‘Oh my God, this is so wrong.’”

Come for the tech, stay for the sound money principles.

An engineer by trade, Ivy first got into bitcoin for the tech. But it wasn’t long before its properties as a currency–deflationary, decentralized, and permissionless–became the main draws.

“As I dug deeper, I realized it also solves most of the economic problems,” she said. “They're not going to print more, there's not going to be inflation."

She became something of a bitcoin evangelist, devoting her career to its proliferation.

Ivy’s father, like many in Brazil, had long used a different tool to beat inflation: real estate. But something about bitcoin just clicked. In an “ah ha” moment of his own, he decided to sell much of his property and get into bitcoin.

“I was doing custody for them. I kept their key because I thought they might lose it, and with single-sig, they’d never be able to restore it,” she said.

“When they decided to invest more money, I thought it was time to move to a multisig setup.”

From single-sig to multi-sig

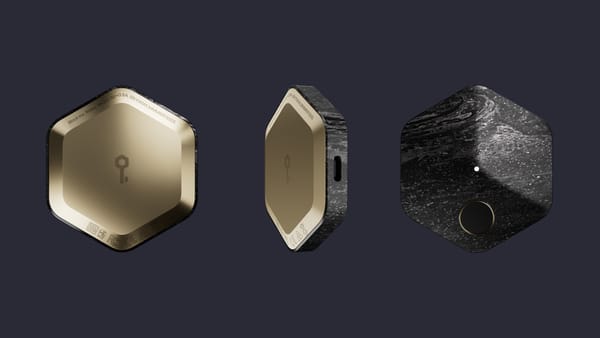

Traditional multi-sig setups offer huge improvements in security and a slightly better chance of recoverability in the case of accidental loss compared to single-sig wallets. But they’re still far too complicated for someone who hasn’t spent hundreds of hours studying bitcoin and developed a high level of technical expertise.

“There’s the traditional multisig setup where you throw the dice, set up your seed, use multiple devices, and have to secure all of that,” says Ivy. “But I thought, ‘How am I going to explain that to my parents?’ If I tried to explain all that, they'd probably say, ‘No, I'm out. Sell everything I have.’ So I was trying to find the easiest way.”

And it’s not like her folks can’t use technology. They use smartphones and online banking and are generally comfortable with new technology. But the risk of accidental loss with single-sig devices, and the sheer complexity of most multi-sig self-custody schemes became too much to weigh against a meaningful bitcoin balance.

“I would have to go through the whole process of generating keys and writing them down. I didn't want to do that because if something happened to me, how would my parents recover their money? It would be lost with me,” she said. “That's why I thought Bitkey was the best option for them.”

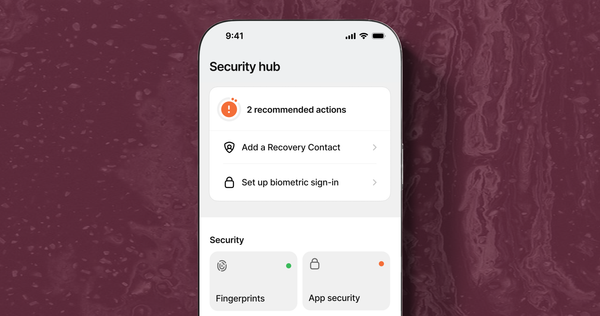

A multi-sig wallet that’s easy to use, with strong recovery tools and an inheritance feature ticked all the “what happens if” boxes.

“My favorite feature is that I can set myself up as their [trusted contact]. So if something happens, I can help them recover their funds,” says Ivy. “Also the inheritance feature. While it's sad to think about, it's going to make things much easier when needed.”

Bitkey and the future of bitcoin adoption

Today, every single self custody offering forces users to make compromises–whether in privacy, security, safety, usability, or some combination of things. When it comes to mass adoption, particularly in self custody, usability is a real hurdle for a lot of people. When you look at most multi-sig setups, it’s really no mystery as to why.

“I believe that, in the process of Bitcoin adoption, there won’t be many people willing to understand the depth of Bitcoin–how to properly generate entropy with dice, how to stamp metal plates,” says Ivy. “They’re never going to do that.”

That’s part of why we built Bitkey–self custody with strong safety, strong security, and strong recovery tools in a format anyone can use. At the end of the day, the best self custody wallet is the one that people will use. And for an increasing number of people, that wallet is Bitkey.

“I recommend it all the time,” says Ivy. “Every time someone asks about which wallet to start with, I tell them Bitkey is my favorite.”

[1] https://www.latimes.com/archives/la-xpm-1990-05-20-mn-303-story.html

[2] https://www.nytimes.com/1992/11/08/magazine/looting-brazil.html