We have shared that we are building for the next 100 million people who have not yet accessed bitcoin for its investment, savings, or payments benefits. Today, the vast majority of the estimated 175M global bitcoin owners - many of whom are located in emerging economies - don't actually have their bitcoin keys. Instead they rely on custodians: institutions who hold their keys, and thus control their money. In the future world of decentralized finance and social infrastructure, we believe customers will demand ownership and self-custody because it brings peace of mind, reduces dependence on any one company and puts them in control of their own money. Put simply: when a custodial wallet owns your bitcoin key, that custodian, not you, owns the decisions about when and how you can access your money, how your money is kept secure, and whether you can even access their services in the first place.

Self-custody of bitcoin, however, hasn’t offered a substantially better alternative yet. Today, keeping your own keys isn’t as simple as it sounds, and often isn’t as safe as people need. Early adopters who hold their own keys today often rely on a complex set of apps and hardware devices that are extremely technical and hard to use. Often the only way to recover your money if you lose your phone or hardware wallet is to rely on a 12- or 24-word secret phrase – which we think customers will either forget, or more likely out of a fear of forgetting, write on a post-it note.

Additionally, self-custody wallets today are designed to be largely inaccessible lockboxes for storing long-term reserves – hard to access, and especially so if you lose the keys. People don’t just need long-term protection of their bitcoin though – they also need to manage their money with easy ways to make a payment, get paid or send money to a friend or family member.

All of this erodes the benefits of bitcoin because it makes it more challenging to access. We believe a better product experience that allows customers to both own and manage their bitcoin can lead to better financial opportunities for people.

Two Jobs To Be Done

We are building a wallet that allows people to build and protect their long-term savings, as well as support the payments use cases we expect bitcoin to support increasingly in the years ahead. This includes the ability to send and receive bitcoin across traditional international borders which has historically been a series of expensive, slow-moving, patched-together domestic payments in the fiat world.

Our opportunity is to build a safe and easy way for people from all around the world with different experiences with technology and financial services to own bitcoin and manage their money with confidence – on their own terms.

That means we want to serve two Jobs To Be Done for our customers:

- Help me own bitcoin easily and safely. Ownership of your keys means ownership of your money. We are building a wallet that prioritizes security and great customer experiences equally.

- Help me manage my bitcoin by making it easy to send and receive money anywhere in the world quickly, easily, and cost-effectively. Bitcoin, especially with its layer 2 innovation, Lightning, can help people send and receive money between friends, families, and businesses – both internationally and domestically. This decentralized payments network has the potential to create a more inclusive financial system for those who have traditionally been underserved.

Product Principles: A compass for the journey ahead

While we remain focused on building the first version of our product, we wanted to make sure we had guiding principles that would make our subsequent product decisions easier in the future. Building in the short-term is a lot easier if you know where you want to go.

We developed a set of Product Principles that we use when navigating tough design, product, and technical decisions. These principles also serve as a guidepost as we build partnerships and build our marketing plans to reach customers. Finally, our Product Principles inform things like our brand and enable us to grow a team of people who are equally inspired by the opportunities ahead.

Product Principles are not set in stone or engraved in metal plates - but rather evolve over time through customer feedback, experimentation and building. We expect these initial principles will evolve over time as we get more feedback from customers and build among an evolving technical landscape.

Our Product Principles

1. Simple and safe financial tools will empower people to access and benefit from bitcoin.

Today, it is very challenging for a wide audience globally to (a) understand bitcoin; (b) find, buy, sell and hold bitcoin; and (c) safely, cost-effectively and easily move between bitcoin and other means of wealth such as their local fiat currencies.

A self-custody wallet that makes it easy for people newer to bitcoin to adopt bitcoin for either or both of its long-term savings and payments use cases will expand economic opportunities for more people in the long-term. Great experiences that don’t expect customers to possess expert technical knowledge on bitcoin’s infrastructure will enable more people to benefit over the long-term.

2. A customer should own their money with confidence and peace of mind.

Owning your own bitcoin means owning your keys, and thus owning your money.

We believe low-level anxiety shouldn’t be the price of good security. We will support customers with a set of defined tools that allows them to help themselves when something goes wrong.

The customer’s wallet will have different permissions and optionality built-in to allow them to use these self-serve tools in a way that fits their needs, which will likely vary across customers and regions of the world. With clear choices about what layers of protection they add to their money, customers will gain more confidence about their financial future.

3. A customer should be able to manage their money quickly, easily, and cost-effectively on their own terms.

We are not in a bitcoin-only world today and customers need to gracefully navigate between their fiat money and their bitcoin money. Customers shouldn’t have to wade through technical discussions on whether something is on-chain or off-chain, what node they’re connecting to, or what QR code is going to work with their family member’s wallet in another country.

Further, as we see in many parts of the world already, bitcoin isn’t just a store of value. It’s increasingly used to send and receive money between friends and families internationally. We will ensure our wallet creates great experiences for this use case.

4. We build transparently together with partners.

Partners and collaborators will help build and get our product in the hands of customers.

While we are not building an exchange where customers can buy and sell bitcoin, we know they need a smooth experience when moving between traditional fiat currencies and crypto currency. We expect to work with partners that solve this well already. Thus, we’ll rely on partnerships with exchanges, other wallets, traditional financial institutions, and payments providers, to help customers connect to services that allow them to buy and sell their bitcoin.

We expect to have distribution and payments partners such as telecommunications companies and retailers. We think those partners will be key to our distribution and go to market efforts: customers will discover our product through our partners' stronger local presences and brands, especially in the countries where we expect to make the biggest economic impact. Additionally, these partners have established payments relationships with their customers locally so paying for the bitcoin wallet becomes easier through partners.

Transparency is key to building trust with customers and those who we work with to serve them. Before anything is ever delivered in the hands of customers, we expect to openly, iteratively communicate with the developer, security and bitcoin communities to (a) build trust and auditability; and (b) collaboratively build upon standards in key design, product and technical topics.

5. Global-first always.

Bitcoin is the internet’s native digital currency, and by definition, borderless. The geographic scope in which we tackle this problem aims to be as broad as possible.

We will be available in as many countries as possible, as early as possible. We’ll have an evolving circle of availability. We’ll always think global when recruiting and building our team, hiring suppliers and manufacturing partners, when building product and GTM partnerships - and above all - when listening to customers’ needs.

So what are we building?

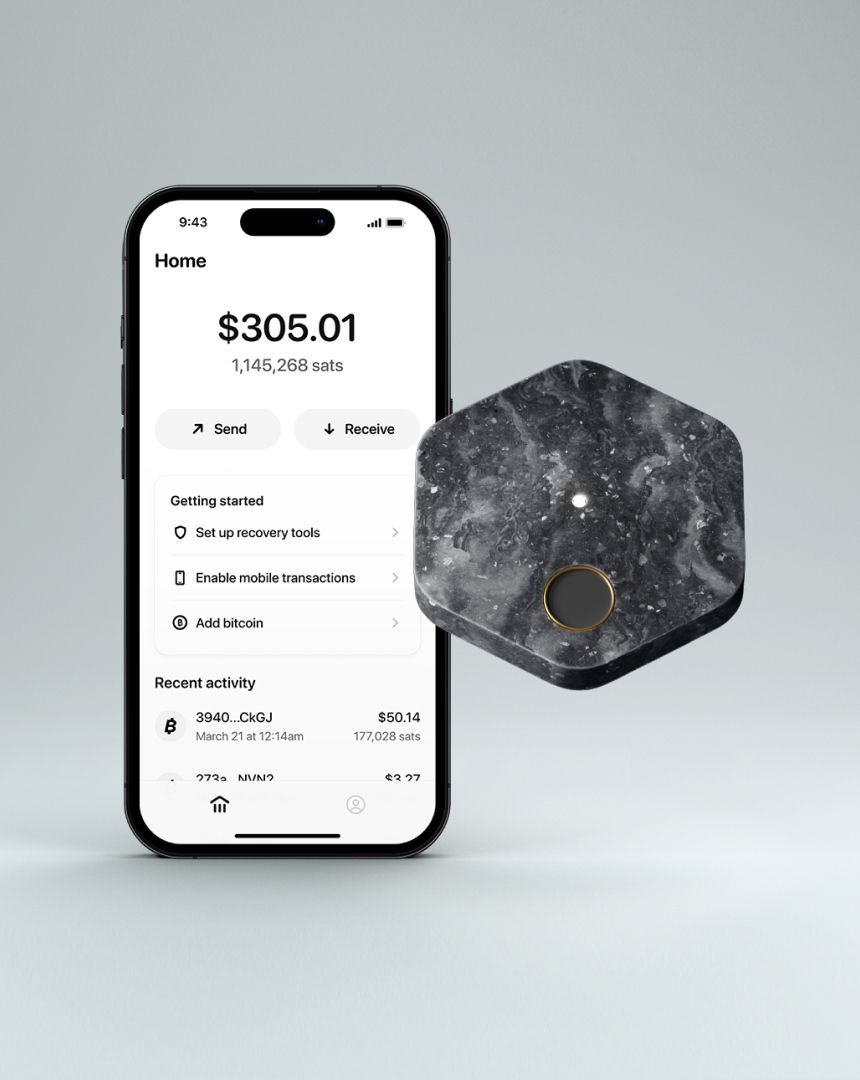

As we shared in our last post, the wallet is comprised of 3 things:

- A mobile app that’s easy to use and allows customers to safely own and manage their bitcoin, while finding partners that can facilitate converting between fiat and bitcoin

- A hardware device that adds additional layers of security when moving larger amounts of money and enables a customer to recover their wallet when they lose their mobile phone

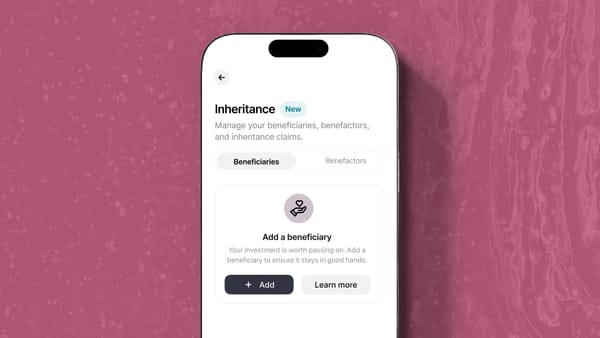

- A recovery service in the form of defined, self-serve customer tools. The recovery services will allow a customer to regain access to their wallet if they lose their mobile phone or the hardware device - or both

This wallet is a 2-of-3 multi-signature key system, which means the customer controls 2 out of 3 keys, and Block controls the remaining 1 key for only one purpose: to help the customer recover their wallet in a set of defined scenarios. Block can never move a customer’s money without their involvement and consent.

We will be sharing more details – and asking our readers for input – about how the wallet will create simple, secure ways for customers to own and manage their bitcoin.

What’s Next?

If this sounds exciting to you, we are hiring! Key open roles include:

- Partnerships Lead

- Software Engineer (iOS)

- Software Engineer (Android)

- Software Engineer (Backend)

- Communications Lead

Have feedback on these Product Principles or what you want to hear about next? Reach us at [email protected].