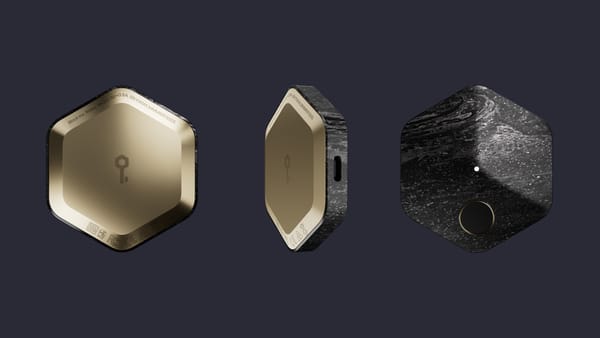

On the other hand, the name of our product is an opportunity to generate a thoughtful conversation around what we’re building, how bitcoin ownership works, and the impact we aim to create for customers when we put the keys in their hands. Truly owning your bitcoin means you have the keys needed to prove that ownership, and what we’re building puts those keys in people’s hands. We’re excited to share how we’ll underscore that with the name for our product.

Today, many people refer to a range of products people use to manage their crypto as ‘wallets’. This isn’t surprising: in the world of dollars, nairas, rupees, and euros, a wallet is something physical you use to store paper cash, debit cards, physical identity documents, or a photo of a loved one. Further, digital wallets have been a catch-all term for things like peer-to-peer apps that aim to improve the experience of legacy banking infrastructure.

Even though some fiat metaphors can be helpful when explaining how bitcoin works, the problem with using terms like ‘wallet’ for these products is that doing so starts the conversation from an inaccurate place, and risks creating misunderstanding from the start – especially for people who are new to bitcoin. Why? With bitcoin, people’s money isn’t stored in any wallet product they’re using – it’s stored on a distributed ledger where money exists in digital rather than physical form, and is issued and controlled by a protocol, not by a single person, company, government, or organization.

If your money then is stored on the distributed public ledger, what is stored in the self-custody product we’re building to help people truly own their money? The answer: keys. Keys that prove to the bitcoin network that you own and control money that hasn’t already been spent by someone else. Keys that mean ultimately you have the autonomy to save your money, spend it, or send it anywhere in the world - unlocking your ability to use a global network with one single currency.

As we considered what to call the product we’re building, we explored a range of names – but ultimately, what we cared about the most was having a name that starts a conversation about bitcoin ownership. A chance to educate both people new to bitcoin, as well as those who may have already bought, held, or sold bitcoin before and did so not by holding their own keys, but by putting a massive amount of trust in third parties to safeguard their money for them. If we’re trying to enable more people to move bitcoin from custodial, centralized exchanges to self-custody that puts the individual in control of their money, then we should also be clear and direct about what defines bitcoin ownership when we choose a name.

Keys are at the heart of our product: Bitkey.

[Ok, back to building.]